Gold as a commodity has an asymmetric character. It tends to perform well when the economy is performing badly and strongly in periods of economic strength when inflation is elevated. However, when the economy is in mid-cycle, it tends to lack direction — typically during periods of moderate inflation.

Last summer, gold in USD terms made an all time high of $2,075.47 an ounce on 7 August 2020 (technically a 200% Fibonacci projection level). Not only did it make an all time in high USD terms, but in many major currency terms as well.

Gold as a currency play: gold at an all-time high on 7 August 2020

- USD 1,827.46

- EUR 1,746.11

- GBP 1,575.67

- CHF 1,879.09

- CNY 14,345

Gold price, USD per ounce: daily chart with Fibonacci projections, March 2020—June 2021

Gold was down from August 2020 to levels in June 2021 — 14.6% and near flat on the year for 2021 in USD terms. There has been a lot of talk about gold being an inflation hedge, an alternative to cryptocurrencies and correlated to real US yields. However, we are focusing on the key indicators, and the possibilities are of the gold price going forward.

What’s effecting the gold price?

Central Bank activity and their gold reserves

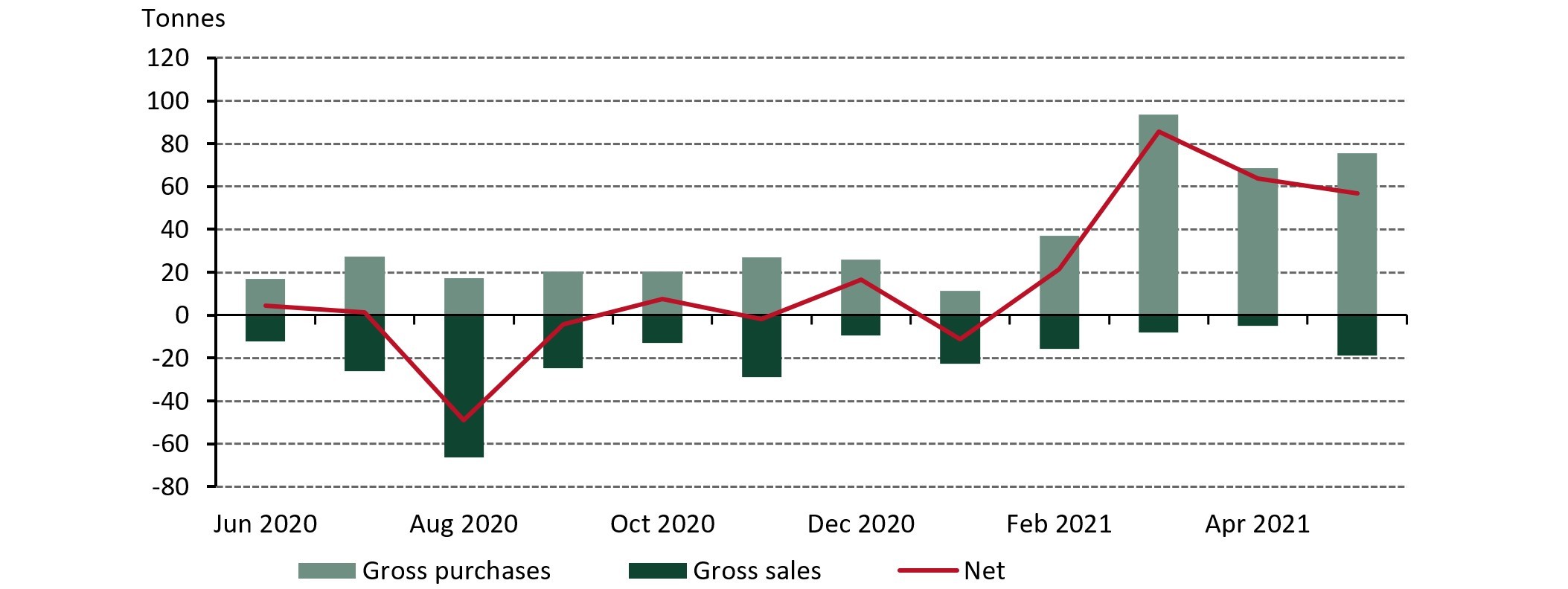

Roughly 33% of the world’s mined gold reserves are owned by central banks. Following a higher level of monthly net purchases in March and April 2021, this trend continued into May. Central banks’ net purchases totalled a healthy 56.7t during the month, down 11% month on month, but 43% above the YTD monthly average. The steady buying in recent months stands in contrast to the more choppy picture from mid-2020 when central banks switched between net buying and net selling.

Central Bank net buys in tonnes, June 2020-April 2021. Source: IMF, World Gold Council

Recent activity has been driven by Thailand and Hungary buying more than 150t between them from March to May 2021. Recent weeks have seen 6 Central Banks buying gold, namely Thailand, Brazil, Turkey, Kazakhstan, Poland and India. But the bigger picture is more focused on China. [link to blog Gold activity and central banks]

The big buyers: China and Russia

China has long term ambition to hold as much gold as the US as a gold to GDP ratio, thus for the coming years China will be a net buyer as well as being the worlds largest producer of the commodity.

Top 10 holdings to April 2021, World Gold Council

|

Country |

Tonnes |

Foreign reserves in gold |

|

US |

8,134 |

79% |

|

Germany |

3,370 |

76% |

|

Italy |

2,452 |

71% |

|

France |

2,436 |

66% |

|

Russia |

2,300 |

23% |

|

China |

1,948 |

3% |

|

Switzerland |

1,040 |

7% |

|

Japan |

765 |

3% |

|

India |

658 |

8% |

|

Netherlands |

613 |

71% |

(Photo: Shutterstock)

.jpg)